Feb 02, 2026

Matleena S.

9min Read

Software as a service (SaaS) has become the preferred way businesses access software, thanks to its flexibility and cloud-based delivery.

But just how widespread is SaaS today, and what does its future look like? This article presents the latest SaaS statistics and trends for 2026 – covering everything from market growth and adoption to spending patterns and emerging technologies.

We’ll explore how fast the SaaS market is growing, how businesses are using and paying for SaaS, and the impact that innovations like AI are having on the industry.

The SaaS market continues to grow rapidly, driven by increasing cloud adoption and digital transformation across industries. Below, we examine the size of the global and regional markets, growth forecasts, and the expanding reach of SaaS providers worldwide.

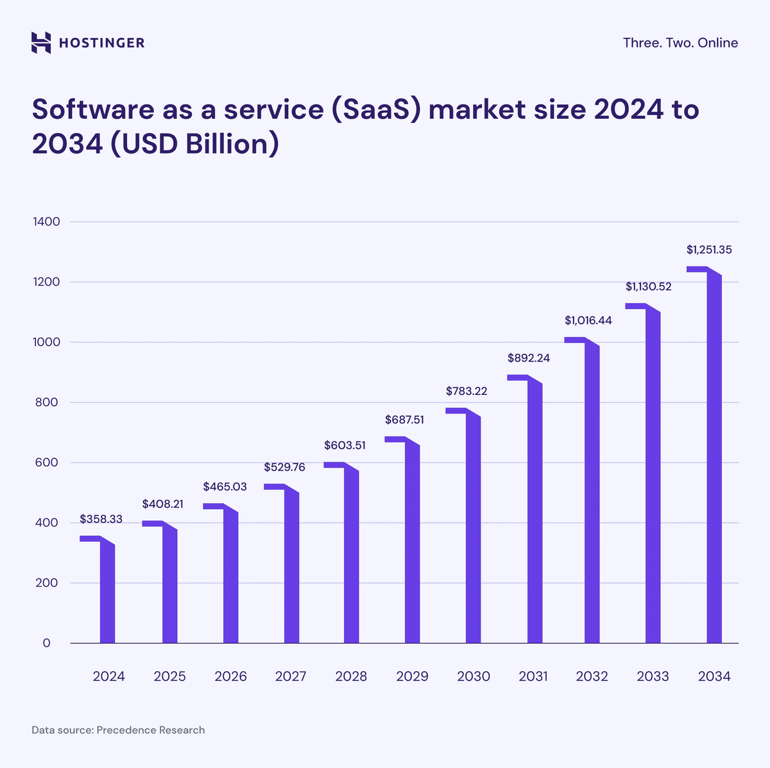

The global SaaS market is projected to expand steadily, reaching $1.25 trillion by 2034. This growth is driven by a compound annual growth rate (CAGR) of roughly 13%, reflecting the ongoing adoption of cloud software by businesses worldwide.

The U.S. SaaS market is expected to exceed $412 billion by 2034, tracking closely with global market trends. With a CAGR of 13%, the U.S. remains a key player fueling the overall expansion of SaaS services.

By 2026, North America’s SaaS sector is estimated to hit $211.7 billion, up from $164.8 billion in 2024. Growing at an impressive annual rate of 13.36%, North America held a commanding 46% share of the global SaaS market in 2024, underscoring its leadership role.

U.S.-based SaaS providers reach an estimated 14 billion users globally, demonstrating their extensive influence across both consumer and enterprise markets. This vast user base allows these companies to gather diverse data and feedback, enabling faster innovation cycles and more tailored solutions that better serve varied customer needs worldwide.

As SaaS adoption nears saturation in many sectors, usage patterns are becoming more complex. This section explores how organizations manage their growing number of SaaS applications, leverage automation, and how buying behaviors are shifting within companies.

Most organizations (81%) have automated at least one process involving SaaS. Automation reduces repetitive manual tasks, improves accuracy, and helps companies manage complex SaaS environments more efficiently, especially as the number of applications grows.

About 30% of organizations use specialized SaaS management platforms to track usage, costs, and performance. These tools enable better visibility into SaaS spending and help prevent waste by identifying underused or redundant applications.

There are over 30,800 SaaS companies worldwide, collectively serving millions of users across industries. This vast and diverse ecosystem fosters innovation and specialization, allowing businesses of all sizes and sectors to find tailored SaaS solutions that fit their unique needs.

The private cloud accounts for 44% of the SaaS market share, making it the leading deployment model. The global cloud services market, which includes private cloud SaaS, is estimated at $721.87 billion in 2025 and is projected to reach $2.73 trillion by 2034, growing at a CAGR of 16%. This significant growth reflects organizations’ preference for private clouds due to enhanced control and security.

In 2024, companies used an average of 106 SaaS applications each. This high number highlights the growing complexity of managing multiple tools, which is driving many organizations to consolidate their SaaS portfolios to improve efficiency and reduce costs.

“Citizen SaaS buyers” – employees outside the IT department who buy software for their teams – now influence 40% of all company SaaS spending. This shift decentralizes purchasing decisions, speeding up software adoption but also increasing the need for coordinated governance to avoid redundancy and security risks.

Investment in SaaS keeps rising, but with greater spending comes the need for better budget management and cost optimization. In this section, we cover how organizations allocate SaaS budgets, respond to economic pressures, and prioritize solutions that deliver real value.

Global spending on SaaS is expected to hit $300 billion by 2025, reflecting strong and steady investment in cloud software across industries. This sustained growth indicates that businesses view SaaS as a critical enabler of digital transformation and operational flexibility.

Economic uncertainties have forced 42% of organizations to cut SaaS budgets, signaling a more cautious approach to software expenses. Companies are focusing on optimizing existing tools and eliminating unused licenses to maximize ROI amid tighter financial conditions.

Many businesses adopt CRM SaaS platforms to lower IT expenses and enable smoother growth. Cloud-based CRM systems offer easier updates, better collaboration, and scalable customer management without heavy upfront investments.

On average, companies spend up to $3,500 per employee each year on SaaS tools spanning communication, project management, and other productivity apps. This figure reflects how deeply SaaS is integrated into daily operations, and it’s pushing organizations to track per-user value more closely to ensure ROI.

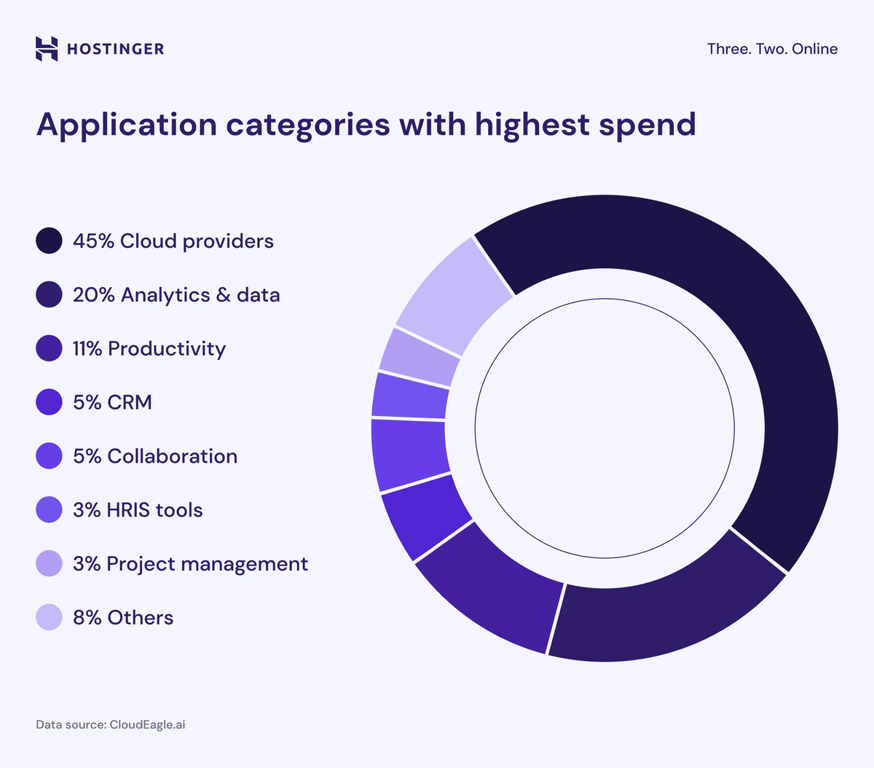

Cloud SaaS platforms represent nearly half of all SaaS spending, indicating that companies allocate most of their software budget to essential, widely used cloud applications. Cloud solutions offer organizations flexibility, scalability, and easier updates – allowing businesses to adapt quickly to market changes and operate more efficiently.

Customer retention is crucial for SaaS success, and represents an important goal of SaaS marketing. High churn rates can threaten growth and profitability, while positive retention drives recurring revenue. This section presents key metrics that reveal how SaaS companies are managing churn and growing revenue from existing customers.

B2B SaaS firms are seeing an average monthly churn rate of 3.5% in 2025, which means companies lose a small but steady portion of customers each month. Managing and reducing this churn is crucial because retaining existing customers is generally more cost-effective than acquiring new ones, directly impacting long-term revenue growth.

Nearly 70% of new users stop using software within three months, showing that user retention is a major challenge. This churn rate is higher compared to other industries, reflecting how critical early engagement and product fit are in SaaS.

Many users frequently abandon apps within marketing and sales software stacks, creating “hidden churn” where users remain subscribed but stop actively using the product. This disconnect can lead to inflated usage metrics and unexpected revenue loss, making it harder for SaaS companies to accurately assess customer engagement and optimize their software investments.

The median net revenue retention for SaaS companies is 102%, meaning companies typically grow revenue from existing customers even after accounting for churn. This positive NRR reflects successful upselling and cross-selling efforts, which are key to sustainable growth in the SaaS business model.

Artificial intelligence and other technologies are transforming the SaaS landscape. Below, we highlight how AI-powered applications are being adopted rapidly, changing data strategies, and creating new challenges and efficiencies in SaaS management.

According to our AI in business report, 95% of organizations are expected to use AI-powered SaaS applications by 2025. In fact, 51% of companies use generative AI, and 42% use natural language processing (NLP) tools. This rapid adoption shows AI’s growing role in automating tasks and enhancing software capabilities across industries.

As per the most recent AI statistics, in the next few years, one-third of enterprise applications will use agentic AI to automate decision-making for about 15% of work tasks. This reflects AI’s increasing impact on productivity by reducing human workload. AI is expected to automate 30% of U.S. work hours by 2030, highlighting its transformative effect.

Around 70% of organizations plan to shift from relying on big data to using “small and wide” data, which focuses on smaller, more diverse datasets. This approach improves data quality and relevance, helping companies generate more accurate insights and better support AI applications without the complexity and cost of managing massive data volumes.

AI-powered applications are fueling new challenges with shadow IT, where employees deploy software without formal IT approval. This rapid, decentralized adoption can increase security risks and compliance issues, making it harder for organizations to maintain control over their IT environments.

As automation trends go, agentic AI technologies reduce customer support handling time by more than half (52%), saving companies hundreds of thousands of work hours. This significant time saving boosts operational efficiency and helps lower overall support costs.

SaaS impacts industries differently, with certain sectors leading adoption and innovation. In this section, we break down SaaS usage and market trends by industry, highlighting where growth is the strongest and how niche SaaS players are carving out specialized opportunities.

The leading SaaS sectors are AI, data analytics, and financial services, with around 4,300 companies operating in these areas. These sectors are growing fast because they offer critical tools that help businesses make smarter decisions, automate processes, and manage finances more effectively.

The health cloud SaaS market is forecasted to reach $452.4 billion by 2029, growing at a compound annual growth rate (CAGR) of about 26%. This rapid growth is driven by healthcare’s increasing need for digital patient records, telehealth services, and efficient data management.

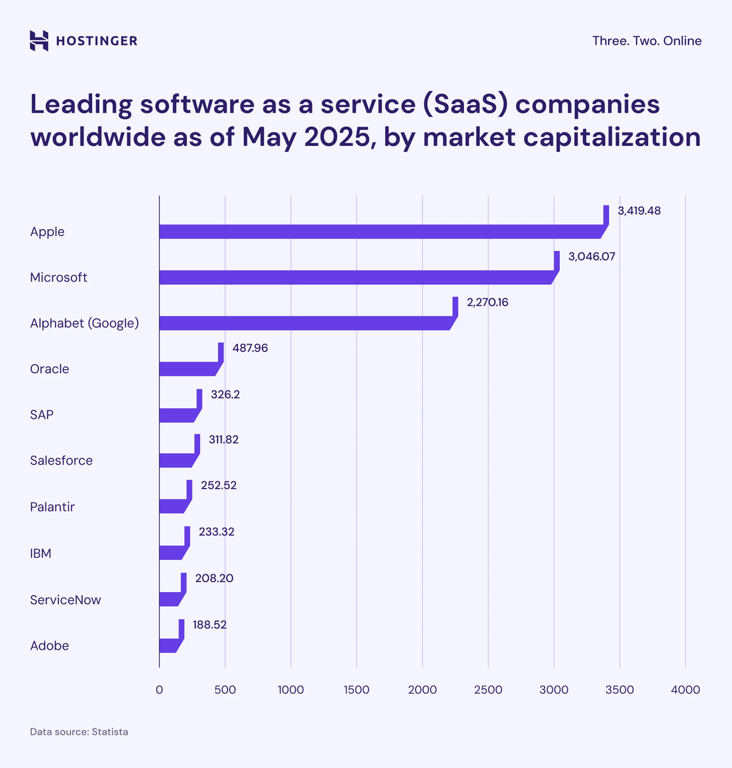

Apple tops the global SaaS market with a $3.42 trillion valuation, followed by other tech giants like Microsoft and Amazon. This dominance reflects their extensive cloud-based service offerings and subscription products that power businesses and consumers worldwide.

The IT and telecommunications sector leads SaaS adoption, with 84% of executives reporting improved security thanks to SaaS. It’s clear that SaaS platforms help these industries strengthen their data protection and meet compliance requirements more effectively.

Micro SaaS startups are becoming more common, often achieving profit margins up to 80% thanks to their low overhead and specialized focus. Their ability to serve niche markets with tailored solutions allows them to operate efficiently and scale rapidly without large teams.

About 38% of organizations are moving their analytics data to cloud and SaaS platforms to take advantage of faster processing speeds, easier access from anywhere, and the ability to scale resources as needed.

The SaaS industry in 2025 shows strong growth and widespread adoption, with a global market nearing $400 billion and rising.

Organizations now use an average of 106 SaaS apps each, reflecting rapid adoption but also growing complexity in managing these tools. Around 81% of companies automate at least one SaaS process, improving efficiency amid this complexity.

Meanwhile, “citizen buyers” influence 40% of SaaS spending, showing how purchasing decisions are decentralizing. From the providers’ side, a 3.5% monthly churn rate in B2B SaaS underscores the ongoing challenge of customer retention, making engagement strategies more important than ever.

Overall, the market is expanding and evolving, with both users and providers focusing on smarter budgeting and harnessing AI and automation to boost performance.

AI integration and automation are among the biggest new trends in SaaS. Over half of companies now use generative AI tools, and by 2025 about 70% will adopt small and wide data strategies to enhance AI. Businesses also prioritize security and integrations when choosing SaaS products.

Successful SaaS companies typically retain 90–95% of customers annually (about 5–10% churn per year). The “success rate” for new SaaS startups is low (only a minority achieve sustained growth), but those that find product-market fit can grow 30%+ yearly. Keeping churn under ~5% and achieving net positive revenue retention are key success benchmarks.

Marketing SaaS is a major part of the cloud software industry, valued at tens of billions. By 2025, companies will spend over $20 billion yearly on tools like marketing automation, CRM, and email marketing. This segment grows 15–20% annually as businesses focus on customer acquisition and analytics.

All of the tutorial content on this website is subject to Hostinger's rigorous editorial standards and values.