10 most common affiliate marketing scams and how to avoid them

Affiliate marketing scams are fraudulent schemes to manipulate tracking systems, steal commissions, or deceive participants for financial gain.

These deceptive practices exploit vulnerabilities in affiliate programs, harming both merchants and affiliate marketers through stolen revenue, wasted budgets, and damaged reputations.

If you’re an affiliate marketer, watch for these common schemes:

- Cookie manipulation. Fraudsters secretly drop tracking codes on browsers to hijack legitimate referrals and claim unearned commissions.

- Counterfeit product promotions. Scammers create fake listings for non-existent products using trusted brand names to collect payments and steal personal data.

- Unrealistic income promises. Fraudulent programs use exaggerated earning claims to lure inexperienced affiliates into schemes that waste their money and time.

- Paid membership requirements. Illegitimate programs charge upfront fees to join, unlike reputable networks that are free and earn through actual sales.

- Bot-generated traffic. Automated scripts create fake clicks and impressions that drain advertising budgets without producing real customers.

Merchants face a different set of fraudulent practices:

- Branded search hijacking. Affiliates bid on your company’s trademarked keywords, stealing clicks from your official ads and earning commissions on direct traffic.

- Domain name exploitation. Fraudsters register similar URLs to redirect your organic traffic through their affiliate links.

- Fabricated customer data. Scammers submit worthless sign-ups using stolen or fake information to earn lead-generation payouts.

- Stolen payment information. Criminals use compromised credit cards to make purchases through affiliate links, leaving you responsible for chargebacks while they collect commissions.

- Automated click injection. Malware and hidden code generate false attribution, crediting fraudsters for conversions they never influenced.

Protecting yourself requires vigilance and proactive measures. Affiliate marketers should only join established networks with free sign-ups, verify merchant legitimacy through reviews and company history, and avoid programs making unrealistic income promises.

Meanwhile, businesses need to implement fraud detection tools, regularly audit affiliate traffic patterns for anomalies, screen applicants thoroughly before approval, and establish clear terms prohibiting trademark bidding and URL hijacking.

Both parties benefit from monitoring analytics for suspicious activity, setting up alerts for unusual conversion patterns, and maintaining open communication to address potential fraud quickly.

5 affiliate marketing scams that hurt affiliate marketers

Affiliate marketers face various fraudulent schemes that can damage their reputation, waste advertising budget, and result in commission theft. These scams exploit vulnerabilities in tracking systems and prey on inexperienced marketers.

Cookie stuffing

Cookie stuffing, also known as cookie dropping, allows fraudsters to claim credit for sales they didn’t legitimately refer. In affiliate marketing, it’s the type of fraud where scammers secretly place multiple tracking codes in a visitor’s browser without their knowledge or consent.

When a visitor browses a website, the scammer’s hidden code drops affiliate cookies from various programs onto their device. If that visitor later purchases from any of those merchants, the scammer receives the commission – even though they provided no actual value or referral.

Fake products

Fake product scams involve creating promotional materials for products that don’t actually exist. Scammers build landing pages or ads featuring counterfeit items, often using logos and branding from established companies to appear legitimate.

These fraudsters promote non-existent products to collect payment from unsuspecting customers who never receive anything. They may also use these fake pages to harvest credit card information and personal data.

This scam damages affiliate marketers who unknowingly promote these fake products. Your audience loses trust when they purchase something that never arrives, associating that negative experience with your recommendation.

Get-rich-quick schemes

Get-rich-quick schemes use exaggerated income claims to lure people into fraudulent affiliate programs that promise substantial earnings with minimal effort. These scams typically feature testimonials of people making thousands of dollars within days.

Scammers employ this bait-and-switch approach to collect sign-up fees, steal personal information, or generate fake traffic that creates revenue for them.

These schemes hurt affiliates by wasting their time and money on programs that never deliver promised results. You might pay hundreds of dollars for a “proven system” only to receive outdated or worthless information.

Worse, some schemes require you to recruit others to earn money, turning you into an unwilling participant in the scam and potentially damaging your professional reputation.

➡️ Find out how much affiliate marketers make for your benchmark.

Pay-to-join programs

Pay-to-join scams require an upfront payment to access an affiliate program. Fraudsters claim this fee covers training materials, premium tools, or exclusive merchant access.

This scam hurts affiliate marketers financially and puts sensitive data at risk. When you submit payment information to these fraudulent programs, scammers can steal your credit card details for identity theft.

You can lose the membership fee and much more if your financial information is compromised. Additionally, these programs rarely provide the promised resources, leaving you with no way to earn back your investment.

Legitimate affiliate marketing programs are free to join, as they earn money from successful affiliate sales, not from membership fees.

Spoof traffic

Spoof traffic is an affiliate fraud where scammers use bots and automated scripts to generate fake clicks, impressions, and conversions. This artificial traffic appears legitimate in analytics dashboards but consists entirely of non-human visitors.

Fraudsters primarily target pay-per-click (PPC) and pay-per-impression programs, creating the illusion of high-performing campaigns. Marketing analytics will show hundreds or thousands of referrals to the merchant’s site, but these “visitors” are automated bots that never result in real sales.

This scam hurts affiliate marketers by inflating performance metrics with worthless traffic. If you’re running a PPC campaign and paying for ads, spoof traffic drains your advertising budget without generating any actual customers or revenue.

Merchants may also terminate your affiliate partnership if they detect suspicious traffic patterns, even if you’re not intentionally involved in the fraud.

5 affiliate marketing scams to look out for as a company

Companies running affiliate programs face various fraudulent schemes that can drain marketing budgets, damage brand reputation, and distort performance data. These scams exploit weaknesses in tracking systems and payment structures.

Google Ad hijacking

Google Ad hijacking is an affiliate fraud where scammers create fake ads targeting your branded keywords to steal clicks. These fraudulent ads appear at the top of search results, intercepting customers who are specifically searching for your company.

When users click on these hijacked ads, they’re redirected through the scammer’s affiliate link before landing on your actual website. The fraudster then receives commission for a sale they didn’t legitimately generate, while the customer was already looking for your brand.

This scam hurts your company by increasing customer acquisition costs while paying unearned commissions. For example, if you’re running Google Ads for “Your Brand shoes,” a scammer might bid on the same keyword and rank above your official ad.

You end up paying commissions to the affiliate for customers who would have found you organically or through your own ads. Additionally, you’re competing against your own affiliates for ad space, driving up your cost-per-click and wasting advertising budget on duplicate traffic.

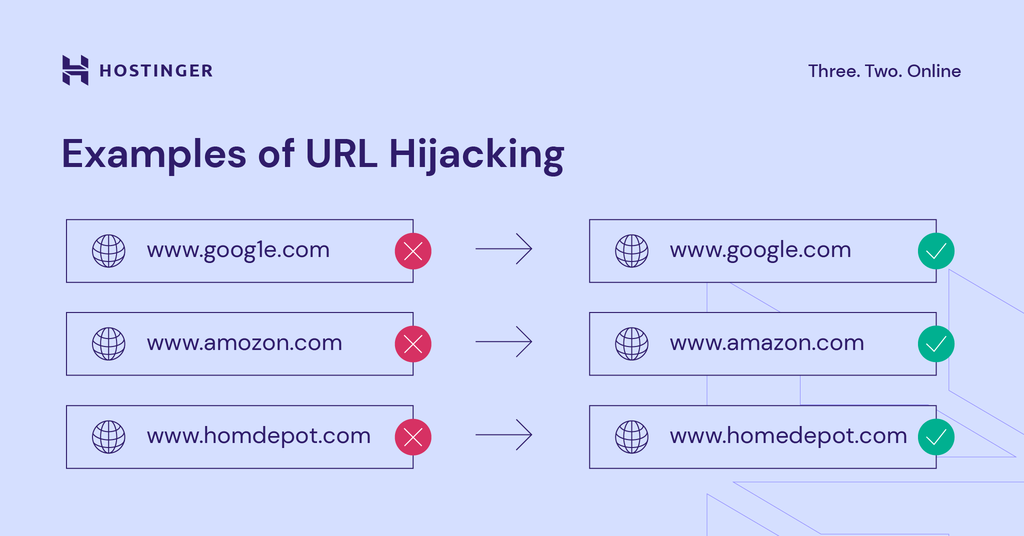

URL hijacking

URL hijacking, also called domain hijacking or typosquatting, occurs when fraudsters register domain names similar to your brand and redirect visitors through their affiliate links. Scammers create websites using misspellings, different extensions, or slight variations of your company name.

For instance, if your brand is techgadgets.com, a scammer might register techgadget.com or techgadgets.net.

When customers accidentally visit these copycat domains, they’re automatically redirected to your legitimate site, but with the scammer’s affiliate tracking code embedded. The fraudster earns commission from sales that would have happened anyway.

This scam damages your company financially, as you pay commissions for direct traffic that naturally belongs to you without affiliate intervention.

Beyond financial loss, these fake sites often clone your content, creating duplicate content issues that hurt your search rankings. Some scammers also use these domains to display competing ads or collect customer data before redirecting.

Fake leads

Fake leads involve affiliates submitting fraudulent sign-ups or registrations using stolen or fabricated information to earn commissions from lead generation. Scammers use bots, purchased data lists, or made-up details to fill out forms and create the appearance of legitimate customer interest.

These worthless leads clog your sales pipeline and waste resources as your team attempts to contact or qualify prospects who don’t exist or have no interest in your product.

This scam costs your company money in multiple ways. You pay commissions for leads that will never convert into customers, wasting marketing budget on zero-value acquisitions.

For example, if you pay $50 per qualified lead and an affiliate submits 100 fake registrations, you lose $5,000 plus the staff time spent trying to contact these non-existent prospects.

Additionally, fake leads distort your performance metrics, making it difficult to accurately assess campaign effectiveness and customer acquisition costs.

Transaction fraud

Transaction fraud occurs when scammers use stolen credit card information or compromised payment accounts to make purchases through affiliate links. Fraudsters complete transactions on your site using stolen financial data, generating commissions for the affiliate while leaving you responsible for chargebacks.

When the legitimate cardholder discovers unauthorized charges and disputes them, your company must process refunds and pay chargeback fees, but the affiliate has already received their commission.

This scam creates a double financial hit for your business. You lose the product or service value from the fraudulent sale and pay the affiliate commission and bank chargeback fees.

For instance, if a scammer makes a $500 purchase using stolen credit card information through an affiliate link earning 10% commission, you pay the affiliate $50, lose the $500 product when the chargeback occurs, and pay an additional $25-50 chargeback fee, totaling over $575 in losses from a single fraudulent transaction.

High volumes of chargebacks can also damage your merchant account status, potentially increasing processing fees or leading to account termination.

Click spam

Click spam is an affiliate fraud where scammers generate fake clicks using malware-infected mobile apps, websites with hidden iframes, or automated bots. This artificial click activity creates false attribution, making it appear that the fraudulent affiliate referred customers who actually found you through other channels.

For example, a scammer might inject click spam through a popular mobile game, generating 10,000 fake clicks daily. If even 20 players who downloaded that game later purchase from your site through legitimate channels (organic search, email, or real affiliate referrals), the click spam gets attributed as the last touch, earning the fraudster commissions in sales they never influenced.

You end up paying for conversions you would have received anyway, while your advertising data becomes unreliable. This makes it difficult to optimize campaigns, identify truly effective affiliates, or calculate accurate return on ad spend for your affiliate program.

How common are affiliate marketing scams?

Affiliate marketing fraud is part of a much larger digital advertising problem. According to Statista, global digital ad fraud costs businesses $84 billion in 2023, with losses projected to exceed $172 billion by 2028.

As affiliate programs scale, they have become increasingly targeted within the broader fraud landscape. Affiliate scams affect nearly every industry and are difficult to detect, often blending in with legitimate traffic. Fraudulent activity can appear across search engine results, social media platforms, YouTube, and online ads.

For businesses, this leads to wasted ad spend, inflated acquisition costs, inaccurate performance data, and payouts for unearned commissions. For legitimate affiliate marketers, fraud creates unfair competition, stolen attributions, reduced trust from brands, and in some cases, stricter program rules or lower commission rates.

Because of these risks, companies should actively monitor their affiliate and digital marketing campaigns, while marketers need to understand how fraud operates to protect their earnings and credibility.

How to avoid affiliate marketing scams as an affiliate marketer

Recognizing affiliate marketing programs you can trust is the most important step to avoid making affiliate marketing mistakes. These are the ways to identify a legitimate affiliate program and avoid scams:

Review the affiliate program’s terms and conditions

Always read the affiliate program’s terms before signing up. A legitimate program clearly explains how commissions are tracked, when payouts are issued, minimum payout thresholds, and acceptable promotional methods.

Be cautious of vague language, missing payout schedules, or clauses that allow the company to withhold commissions without explanation. Unrealistically high commission rates with no clear product pricing or conversion logic can also be a red flag.

Look for the affiliate program’s testimonials and independent reviews

Ask the company for affiliate testimonials, but don’t rely on them alone. Search for reviews on forums, blogs, Reddit, LinkedIn, or social media platforms where affiliates share real experiences.

Pay attention to repeated complaints about late payments, sudden account bans, or commissions being reversed without justification. A mix of positive and critical feedback is normal – only positive reviews can be suspicious.

Test the customer support responsiveness

Reliable affiliate programs invest in supporting their partners. Before committing, contact customer support via email or live chat and ask specific questions about payouts, tracking, or promotional rules.

Fast, helpful, and clear responses indicate a company that values long-term affiliate relationships. Slow replies, generic answers, or no response signal poor management or potential risk.

Research the company’s background

Check how long the company has been operating and whether it has a visible business presence. Legitimate brands often share company history, growth milestones, or affiliate program performance metrics.

You can also look for press mentions, partnerships, or coverage from reputable websites. A complete lack of external references or a newly launched brand with aggressive commission promises deserves extra caution.

Examine search results

Search the affiliate program name along with terms like “review,” “scam,” “payment issues,” or “affiliate experience.” This often reveals patterns that aren’t obvious on the company’s website.

If search results mostly show warning posts, unresolved complaints, or affiliate payout disputes, it’s best to avoid the program.

Check if an anti-fraud policy is available

Credible affiliate programs actively protect both merchants and legitimate affiliates. Look for documentation explaining how fraud is detected, how disputes are handled, and under what conditions commissions may be reversed.

If this information isn’t publicly available, ask support directly. Programs that refuse to explain their fraud prevention approach may expose honest affiliates to sudden penalties or lost earnings.

Look for free signups

Legitimate affiliate programs are free to join. Requiring upfront payments, mandatory “training fees,” or paid access to affiliate links is a common sign of an affiliate marketing scam.

While some programs may offer optional paid tools or resources, participation in the affiliate program itself should not depend on payment.

Start small and monitor your affiliate performance metrics

Before scaling your efforts, test the program with a small amount of traffic. Monitor click tracking, conversions, and reported commissions closely.

If tracking seems inconsistent or commissions don’t match your performance data, pause and investigate before investing more time or resources.

Is affiliate marketing worth doing?

Despite the existence of affiliate marketing scams, affiliate marketing remains a highly profitable and worthwhile business model. The affiliate marketing industry is also projected to grow to $31.7 billion by 2031, as many businesses and content creators increasingly adopt this model.

The benefits of flexibility, unlimited earning potential, and minimal overhead make affiliate marketing an attractive option for entrepreneurs and content creators. When you take time to research programs, read reviews, and avoid offers that seem too good to be true, the risks become manageable.

Successful affiliate marketers generate revenue by promoting legitimate products and building trust with their audience. Most established affiliate networks also implement strict fraud detection systems and provide support to legitimate affiliates.

Read our guide on whether affiliate marketing is worth it to dive deeper into the pros and cons of the business model.

All of the tutorial content on this website is subject to Hostinger's rigorous editorial standards and values.

Comments

October 16 2023

Good , pls tell me the best Affiliate program to join

November 02 2023

Hello there! There are many best affiliate marketing programs you can join. Hopefully, you will find the best one! ?

October 21 2023

Hello, thank you for the information on Affiliate Marketing, looking to dip my toes in the Pool. What Affiliate sites do you recommend i start with. I just want to set it and earn some passive income, can you help me. Thank you

November 07 2023

Hi! You're welcome. The best affiliate program for you depends on your specific needs and goals. We've put together a list of some profitable affiliate marketing programs that you may be interested in. Check them out and see if any of them are a good fit for you ??

February 03 2024

Please how can I know a legit affiliated market to join?

February 07 2024

Hi Lukman! To find a legitimate affiliate marketing program to join, we recommend visiting our article on the best affiliate marketing programs. Feel free to explore the article for valuable recommendations and guidance on choosing the right program for you ?