Feb 10, 2026

Larassatti D.

11min Read

Ecommerce bookkeeping is the process of recording, organizing, and maintaining financial transactions for an online store.

Unlike traditional bookkeeping, online store bookkeeping handles transactions across multiple platforms, payment processors, and sales channels – making it more complex but essential for accurate financial management.

Effective ecommerce bookkeeping follows a five-step workflow:

These steps transform raw transaction data into actionable insights about profitability, cash flow, and business health.

Daily bookkeeping tasks include recording sales and updating inventory levels. Weekly reconciliation confirms that payouts match sales records and catches discrepancies early. Monthly financial statements, such as profit and loss reports, balance sheets, and cash flow statements, provide a high-level view for strategic decision-making.

To make this workflow easier, specialized tools range from $15-30/month for basic bookkeeping software to $500-2,000+/month for full-service ecommerce accounting support.

The actual ecommerce bookkeeping cost will also depend on your transaction volume, number of sales channels, and whether you handle bookkeeping in-house or outsource to specialists.

The definition of ecommerce bookkeeping centers on maintaining a company’s financial health through daily, weekly, and monthly tasks.

Ecommerce bookkeeping also acts as the digital bridge between your sales platforms, payment processors, and business bank account. These systems don’t always sync perfectly, so a bookkeeper’s role is to ensure every sale, fee, refund, and payout is accurately reflected across all tools.

Ultimately, bookkeeping is a foundation of any successful online store, as it transforms raw data into a roadmap for business decisions.

For example, if shipping costs rise faster than revenue, accurate bookkeeping lets you adjust pricing or carrier choices before those costs threaten the long-term health of your business.

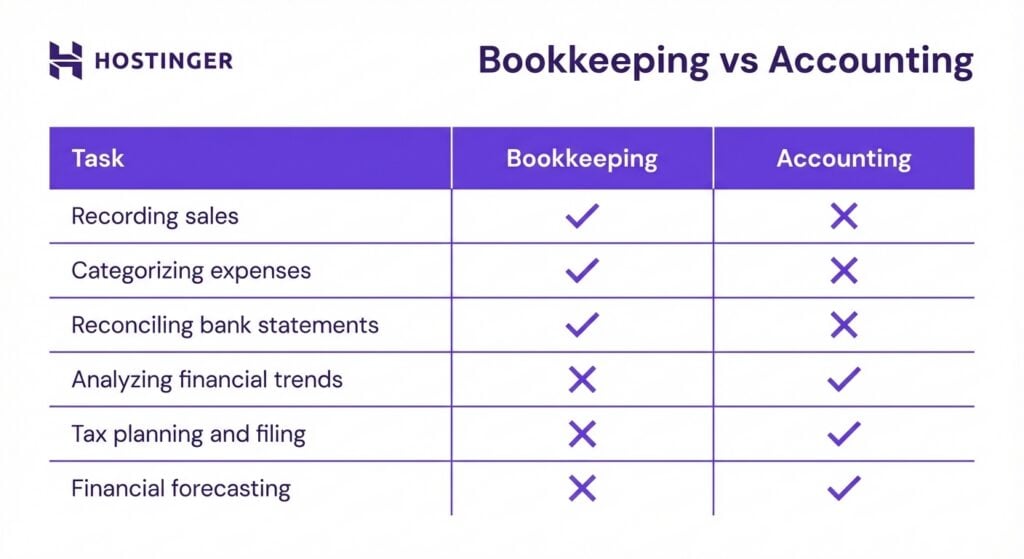

The main difference between ecommerce bookkeeping and accounting is in how financial data is handled and used.

Bookkeeping forms the foundation of an online business’s financial system, which focuses on day-to-day administrative work.

Accounting builds on that foundation. It takes data from bookkeeping and analyzes it to generate financial reports, assess business performance, ensure tax compliance, and support strategic decision-making.

Every ecommerce business needs bookkeeping from day one. Even if you’re just starting an online store, you need consistent transaction tracking to:

Without bookkeeping, it’ll be challenging to understand how the business is actually performing.

Meanwhile, accounting becomes essential as your ecommerce business grows in complexity. You’ll need an accountant when:

In short, bookkeeping keeps your ecommerce business organized, while accounting helps you make informed decisions and stay compliant.

Online store bookkeeping follows a repeatable workflow that captures, categorizes, and verifies financial data across your store, payment processors, and bank accounts.

To make the process easier, you can use automation to pull sales, refunds, fees, and payouts into a central system and categorize transactions. Regular reconciliation confirms that records match actual deposits, keeping the books accurate.

When done consistently, this process creates reliable reports that reflect your business’s financial health and support better decision-making.

Recording sales starts with capturing every transaction across your ecommerce platforms and marketplaces. Document full transaction details from each channel – whether the sale comes from your online store, Amazon, eBay, or other marketplaces. Then, track gross and net sales separately.

Gross sales reflect the original product price before any reductions. Net sales show actual revenue after discounts, refunds, and chargebacks.

Make sure to record discounts, refunds, and chargebacks separately as contra-revenue entries. This prevents inflating your actual sales performance and gives you a clearer picture of how much revenue each channel actually generates.

For example, a customer buys a $100 shirt using a $10 discount code. Your books should record $100 in gross sales and a separate $10 discount entry.

Marketplace fees and payment processor charges should also be tracked independently, rather than netted against revenue, to provide a clearer picture of sales performance and operating costs across each channel.

Once you’ve captured all sales data, the next challenge is understanding where that revenue actually goes, which makes expense tracking the critical second step.

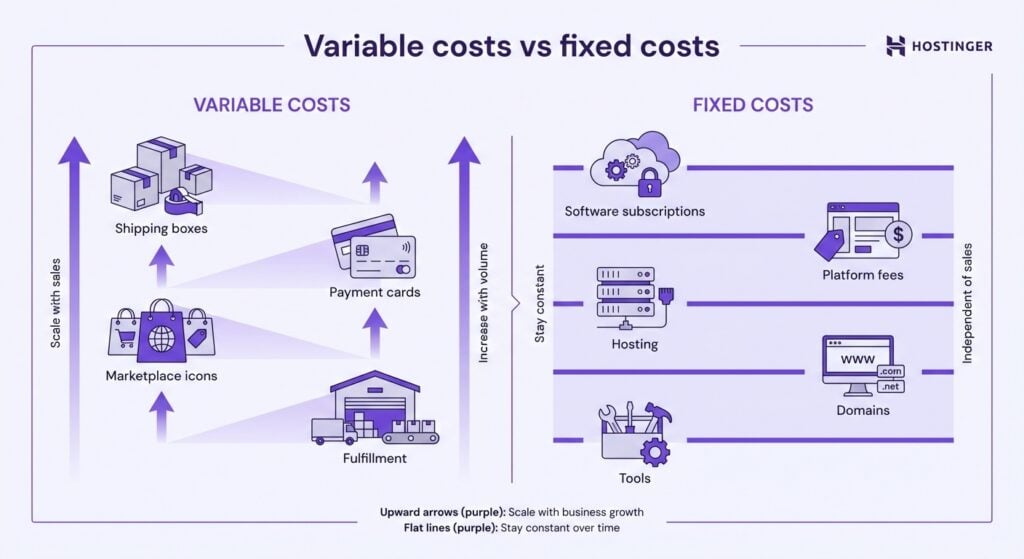

Ecommerce expenses typically fall into two categories: variable costs, which fluctuate with sales volume, and fixed costs, which remain relatively stable month to month.

Variable costs include expenses tied directly to each sale, such as shipping and packaging materials, payment processing fees, marketplace referral fees, and transaction-based fulfillment costs.

As sales increase, these expenses rise as well. For example, if you process 100 orders with $2.50 in shipping costs per transaction, that’s $250. Double your orders to 200, and shipping costs rise to $500. Tracking these costs accurately helps you understand your true cost per order.

Fixed costs are recurring expenses that don’t change based on sales activity. These include software subscriptions, ecommerce platform fees, hosting, domains, and core business tools like email marketing platforms.

No matter if you sell 100 or 1,000 products in a month, these costs remain the same. But they still need to be accounted for to avoid overstating profits.

By consistently categorizing ecommerce expenses, you gain a clearer view of your overhead, protect the accuracy of your financial reports, and make better decisions about pricing, marketing spend, and growth.

While recording sales and expenses tells you what should happen financially, reconciliation confirms what actually happened.

Compare sales, fees, refunds, and payouts recorded in your books against reports from payment processors, ecommerce platforms, and bank statements.

This is often the most challenging part of ecommerce bookkeeping due to timing differences.

Payment processors don’t always deposit funds immediately, as some payouts take several days to settle. Others include rolling reserves, where processors temporarily hold a percentage of your revenue to cover potential chargebacks or disputes.

Stripe, for example, may hold 1-5% of revenue for 90 days for high-risk merchants.

Reconciliation ensures that amounts marked as “pending” in your ecommerce or payment apps eventually match the “available” funds deposited in your bank.

By reconciling regularly, you can confirm that all payouts are received, fees are correctly deducted, and no transactions are missing – keeping your books accurate and your cash flow visible.

The fourth step is tracking inventory accurately so you can calculate your cost of goods sold (COGS) correctly.

Inventory represents money you’ve spent on products that haven’t sold yet, which is why it appears on your balance sheet as an asset rather than an expense.

COGS only includes the direct cost of the products you actually sell during a given period.

For example, if you purchase 1,000 products at $5 each, the full $5,000 remains recorded as inventory. Each time one unit is sold, $5 is moved from inventory to COGS, reflecting the actual cost of that sale.

Ecommerce businesses typically use inventory valuation methods such as first-in, first-out (FIFO) or weighted average cost to determine which inventory costs are assigned to each sale.

With FIFO, you assume the oldest inventory sells first. For example, you purchase 100 units at $5 in January, then 100 units at $6 in February.

When you sell 150 units in March, COGS includes all 100 January units ($500) plus 50 February units ($300), totaling $800. The remaining 50 units stay in inventory at $6 each ($300).

Consistent inventory tracking ensures COGS is reported accurately, margins aren’t overstated, and financial reports reflect your products’ actual profitability.

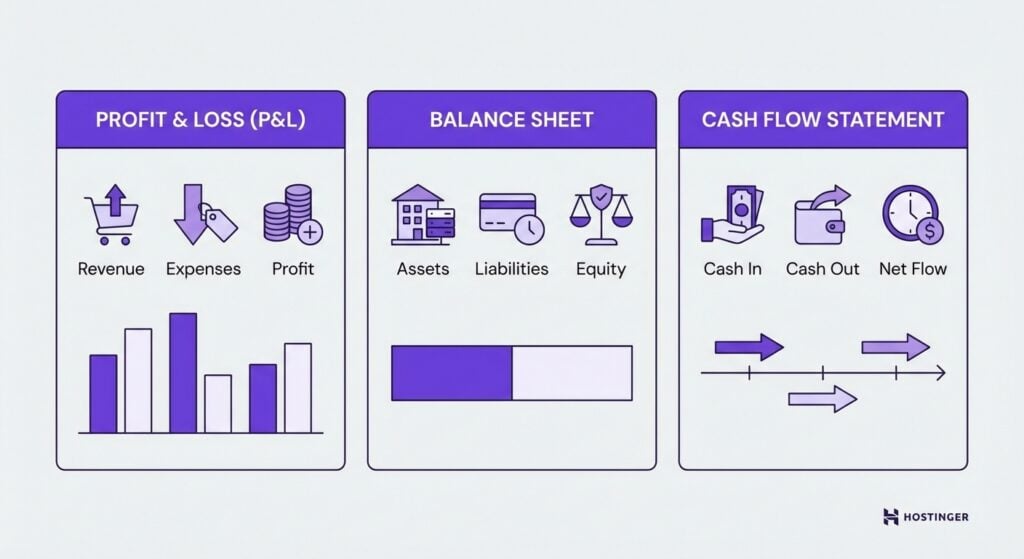

Finally, the ecommerce bookkeeping process culminates in financial reports.

With accurate sales, expense, payment, and inventory data in place, you can generate the financial reports that transform this information into business insights:

Together, these reports turn raw bookkeeping data into financial clarity, allowing you to monitor performance, plan ahead, and avoid cash flow surprises.

Reconciling sales across multiple platforms creates most ecommerce bookkeeping headaches. Hostinger Website Builder eliminates this by centralizing your store operations in one dashboard.

With zero transaction fees, you avoid the complex fee structures that make expense categorization difficult. This means fewer line items to reconcile and clearer profit margins.

The built-in data export capabilities also let you push clean sales data directly into third-party bookkeeping software – reducing manual entry and the errors that come with it. For stores processing 100+ orders monthly, this automation saves 3-5 hours of reconciliation work each week.

Managing an online business requires ecommerce bookkeeping tasks that go beyond traditional brick-and-mortar bookkeeping.

As ecommerce transactions occur across multiple platforms and payment systems, these tasks must be performed consistently to ensure financial data remains accurate and reliable.

The frequency of each task directly affects the trustworthiness of your reports and the speed at which you can spot issues.

One of the most essential ecommerce bookkeeping tasks is tracking revenue across all sales channels where your products are listed. This may include your own ecommerce site as well as marketplaces like Amazon, eBay, or Etsy.

As each platform uses different reporting formats, payout schedules, and fee structures, manual tracking can be difficult and time-consuming.

To maintain accuracy, sales data from each channel should be reviewed regularly and consolidated into a single system.

Using tools that aggregate this data helps ensure you’re seeing a complete picture of your daily revenue without having to log into multiple dashboards or miss marketplace-specific adjustments.

Accurate ecommerce expense tracking involves labeling every outgoing transaction so it can be analyzed, reported, and used for tax purposes. Proper categorization allows you to understand spending patterns, control costs, and calculate true profitability.

Common ecommerce expense categories include:

Consistently categorizing expenses reduces errors and ensures financial reports reflect real operating costs.

Sales tax bookkeeping is one of the most complex responsibilities for ecommerce businesses. Online sellers must track customers’ locations and determine whether they have sales tax nexus – a significant presence in a state that requires tax collection.

Nexus is typically established through physical presence, like offices, warehouses, or employees in a state, or by exceeding economic thresholds. Most states establish nexus when annual sales exceed $100,000, though specific thresholds and rules vary by state.

Bookkeeping supports tax compliance by maintaining detailed records of taxable sales, collected tax amounts, and supporting documentation. Accurate, up-to-date records make it easier to file returns, respond to audits, and avoid penalties caused by under-collection or reporting errors.

Below are some of the best ecommerce bookkeeping tools that can handle both bookkeeping and accounting tasks:

💡 Pro tip: Social commerce sales are expected to reach $8.5 trillion by 2030, making it a significant revenue channel to grow your online store. So, if you plan to sell online across platforms like Instagram, TikTok, and Facebook, make sure your bookkeeping systems can consolidate sales data from these channels alongside traditional marketplaces.

Ecommerce bookkeeping costs vary depending on your store’s size, order volume, and operational complexity. Expenses will increase as transactions and sales channels grow.

Typically, these costs fall into two categories: software subscriptions and bookkeeping labor, whether handled in-house or outsourced.

Most ecommerce businesses rely on a mix of bookkeeping, ecommerce accounting software, and other tools to automate data capture, reconciliation, and reporting. Costs vary depending on features, users, and integration capabilities:

In addition to software, most ecommerce businesses incur labor costs to keep their books accurate and up to date. These costs vary depending on whether bookkeeping is handled in-house or outsourced, as well as your store’s size and complexity.

Errors in ecommerce bookkeeping often cost far more than doing things correctly in the first place. Inaccurate or inconsistent records can lead to tax issues, flawed decision-making, and cash flow problems that directly affect your business’s sustainability.

One of the biggest risks is tax exposure. Missing transactions, misclassified expenses, or incorrect sales tax records can trigger penalties, interest charges, or audits.

When documentation is incomplete, fixing the problem often requires time-consuming rework or the help of professionals, adding unexpected costs on top of the original mistake.

This is where businesses often realize that underestimating bookkeeping software costs or delaying professional help can be more expensive in the long run.

Poor bookkeeping also leads to bad financial decisions. If your numbers are inaccurate, you may think a product is profitable when it’s not, overspend on advertising, or price products without accounting for rising costs. This directly impacts your ecommerce profit margins, making it harder to grow or even stay afloat.

Cash flow issues are another common consequence. Without reliable reconciliation and reporting, businesses may overestimate available cash while funds are still tied up in platform settlement delays or reserves. This can result in missed payments, stalled inventory purchases, or reliance on short-term financing.

In many cases, businesses turn to ecommerce bookkeeping services only after problems arise. While cleanup and correction are possible, they are often more expensive than ongoing, proactive bookkeeping.

For growing stores, investing early in accurate systems or considering outsourced bookkeeping helps prevent costly errors and provides financial clarity as the business scales.

Following proven bookkeeping habits helps ecommerce businesses maintain financial accuracy, reduce errors, and make better decisions as they scale. These best practices are essential for online sellers managing multiple platforms, payment processors, and frequent transactions.

When applied consistently, these habits turn bookkeeping from a reactive task into a proactive tool for managing and growing an ecommerce business.